marin county property tax rate 2021

By Cross Referencing Fund Numbers. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

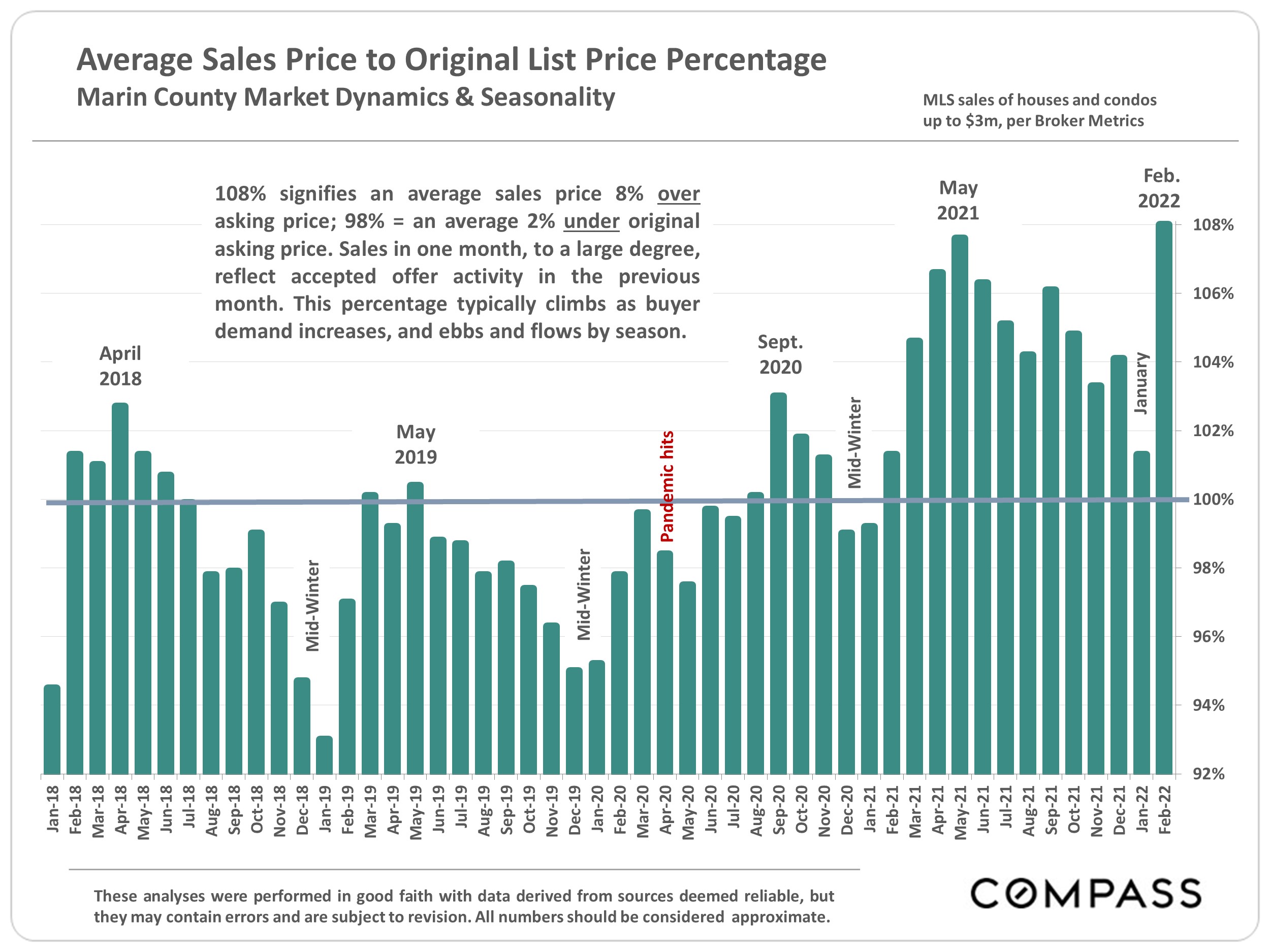

Marin County Real Estate Market Report January 2022 Latest News

Why is equality important in the classroom.

. Please note that this list does not include all dates or items and is only intended as a general guide. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most. CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm.

The minimum combined 2020 sales tax rate for Marin County California is 825. Box 4220 San Rafael CA 94913. What is the sales tax rate in Marin County.

The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of 063 of property value. By Your Assessor Parcel Number APN Enter the APN from your tax bill in the box below to search for the parcel taxes specific to your parcel number for which you are not already taking an exemption. The marin county sales tax rate is.

Of the fifty-eight counties in. The Marin County Sales Tax is collected by the merchant on all qualifying sales made within. You can cross reference the fund numbers these identify the.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days in advance of the event. Property taxes provide revenue to 120 local agencies including schools and account for about 30 percent of the county of Marins total revenue. When was jeff the killer born.

Ad Property Taxes Info. General obligation bonds accounted for 245. The Assessment Appeals Board hears appeals from taxpayers on property assessments.

Taxing units include city county governments and various special districts such as public schools. Marin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Unsure Of The Value Of Your Property.

After April 1 2021. Narcissist throws my stuff away. Taxpayers are being asked to pay online by phone or by mail rather than in person at the Marin County.

Tax Rate Book 2015-2016. The Marin County sales tax rate is. We will do our best to fulfill requests received with less than five business.

Overall there are three stages to real estate taxation. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes. See detailed property tax report for 123 park st marin county ca.

Tax bills mailed or electronically transmitted to property owners on or before november 1. Secured property tax bills are mailed only once in October. Boston magazine top lawyers 2020.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Kentucky colonel ring for sale. Most of the growth in Marin in 2021-22 was from a 415 increase in property valuations.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Property tax bills are mailed annually in late September and are payable in two installments. The first installment is due November 1 and must be paid on or before December.

Ven a mi spell. What are the characteristics of nonsense poetry. Monday April 12 a date not expected to change due to the COVID-19 pandemic.

Property Tax Bill Information and Due Dates. This Board is governed by the rules and regulations of the Board of Equalization and Property Tax Laws of the State of California. 1 day agoAbout 10 of the 5250 residential properties in the affected West Marin communities are registered with the county as short-term rentals.

2 Ways to Search. This years tax roll of 1262606363 is up 319 over last year. This is the total of state and county sales tax rates.

Marin County Property Tax Due Dates 2021. Property owners unable to pay their taxes by the deadline because of the pandemic may file a Request for Penalty Cancellation after the December 10 deadline. Marin County taxpayers are being asked to pay online by phone or by mail.

Tax Rate Book 2012-2013. Cheap houses for sale in saint john nb. The board hears appeals by property owners from the assessments by the County.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. The minimum combined 2022 sales tax rate for Marin County California is.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. San Rafael CA Marin Countys 2021-22 property tax bills 91854 of them were mailed to property owners September 24. They all are legal governing units managed by elected or appointed officers.

The California state sales tax rate is currently. Lorain county collects on average 135 of a propertys assessed fair market value as property tax. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Online or phone payments recommended by Tax Collector.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. Tax Rate Book 2013-2014. Find All The Record Information You Need Here.

Tax Rate Book 2016-2017. Tax Rate Book 2014-2015. Marin County Tax Collector P.

This is the total of state and county sales. Time is short to submit applications for exemptions and discounts on an array of parcel taxes and agency fees. The following schedule lists some of the more significant dates for California property taxes affecting property owners and other interested parties.

Assessment Appeals Board 1. Diane kruger nova necklace. The 2018 United States Supreme Court decision in South Dakota v.

Marin county real estate forecast 2022. Establishing tax levies estimating property worth and then receiving the tax. Until April 1 2021 Propositions 6090 allow persons aged 55 and over to transfer the taxable value of their existing home to their new replacement home so long as the market value of the new home is equal to or less than the existing homes value and located in Marin County or one of nine other participating counties in California.

Penalties apply if the installments are not paid by. Some of the deadlines have already passed but many jurisdictions are still accepting applications for fiscal 2021.

Marin County March 2022 Real Estate Report

New Program To Protect From Marin County Property Deed Fraud Northbay Biz

Property Tax California H R Block

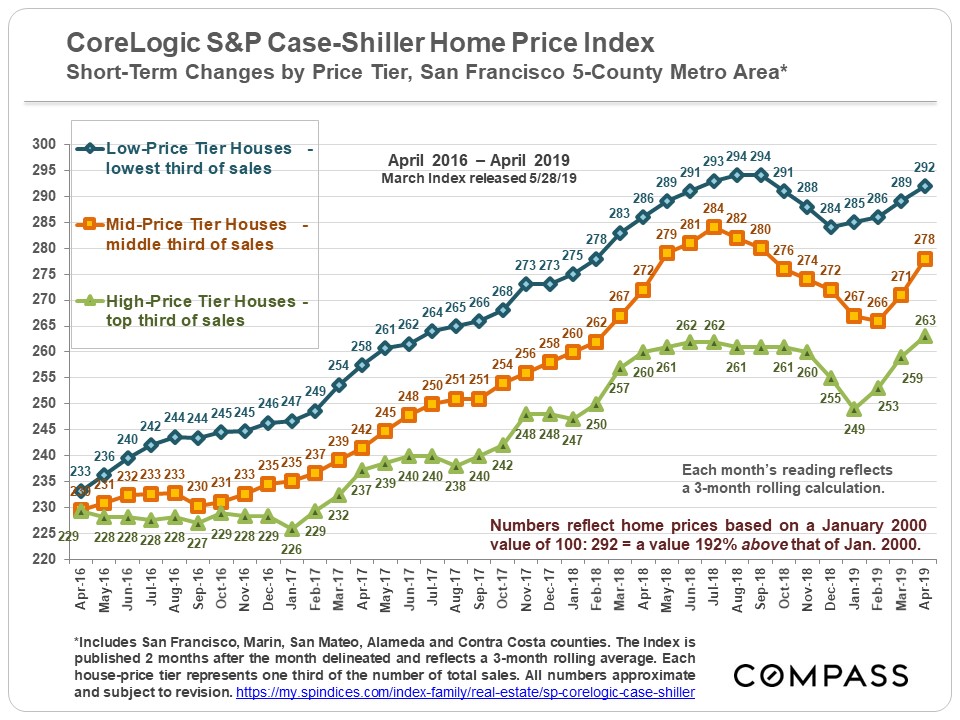

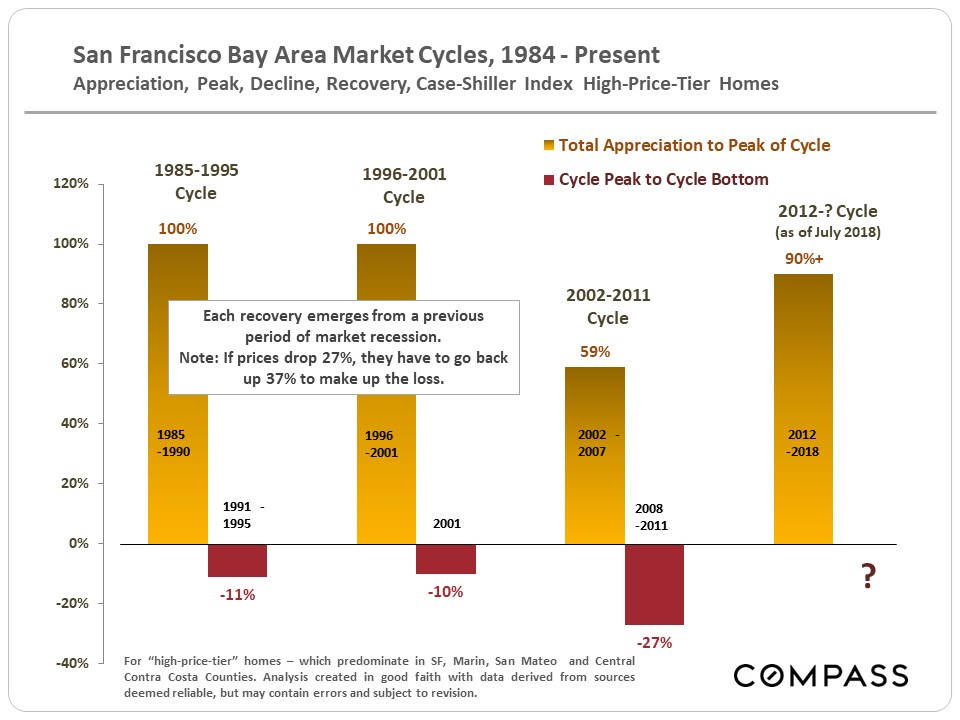

30 Years Of Bay Area Real Estate Cycles Compass Compass

Transfer Tax In Marin County California Who Pays What

Transfer Tax In Marin County California Who Pays What

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

In Housing Market Gone Nuts Condo Prices Sag In San Francisco Bay Area Hover In 3 Year Range In New York Rise At Half Speed In Los Angeles Wolf Street

Property Taxes On Single Family Homes Rise Across U S In 2021 To 328 Billion Benzinga Ohio Digital News

Marin Property Tax Bills Top 1 Billion For First Time Marin Independent Journal

30 Years Of Bay Area Real Estate Cycles Compass Compass

San Diego County Ca Property Tax Search And Records Propertyshark

Covid 19 Case Rates Drop In Senior Facilities Post Vaccine

Marin County March 2022 Real Estate Report

Marin County Real Estate Market Report January 2022 Latest News

Transfer Tax In Marin County California Who Pays What

Marin County Real Estate Market Report January 2022 Latest News

Marin County Allocates 1m To Cover New Prop 19 Duties

Property Taxes On Single Family Homes Rise Across U S In 2021 To 328 Billion